A high relative volume (RVol) is correlated with volatility, which in turn impacts your returns, i.e. profitability.

A stock’s volume for today has 2 aspects – absolute volume and relative volume. They are not the same thing. If you are able to measure relative volume, you are able to know if the trading activity for a stock is increasing or decreasing for today.

(Read on, or go straight to the Unusual Volume Stocks scanner.)

Absolute volume

Absolute volume simply means the volume that has been transacted. It is an important value, but it is not the only measurement of interest and activity.

On its own, the absolute volume gives you some indication of activity, but it is more meaningful when used together with relative volume. This post will explain why.

Relative volume (RVol)

Relative volume is a ratio. It is also often referred to as RVol. It is derived by comparing current volume to average volume for the same time of day.

RVol is the key to understanding volume flows. It helps you understand if today’s trading activity is higher or lower compared to its normal trading behavior.

A high relative volume signifies that there is something going on and that the stock is “in play” today. Unusually high volume is also referred to as a “volume spike”.

A high RVol is the key to knowing if the trading activity is unusually high today.

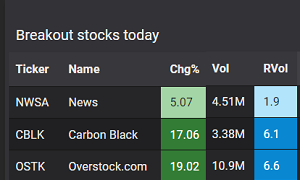

These were some of the results our stock scanner generated on Friday 29 Mar 2019.

We cannot stress enough the importance of using high relative volumes to qualify trading targets.

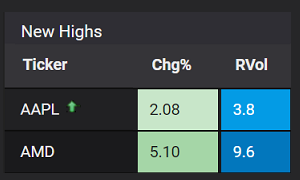

High absolute volume does not mean high relative volume. A high volume figure does not mean a volume spike.

This was the Top Volume list on 29 Mar 2019. All three examples did not appear on the list. If you were searching for trading ideas by searching the Top Volume list, you would have completely missed out on these 3 stocks.

Putting both elements of volume flow together

1) Absolute volume – You want some form of high absolute volume to denote liquidity, which means that there is a sufficient level of interest and counter-parties. This is a subjective measurement and the threshold differs among traders. Some insist on at least 500K while some filter for at least 1 million.

2) Relative volume – A high RVol indicates increased volume flows, which means that there is higher trading interest today.

Experienced traders understand that volume is the fuel of the market, and that it contains different elements. Being able to recognize and apply these elements, will help identify better trading opportunities with higher probabilities.

→ Next: How to find Unusual Volume stocks in real time

About the author

David Miller is the Market Data Engineer at Stockbeep. He has spent more than two decades working across dealing rooms, market data vendors and trading ISVs.

For short term trading, David employs a data-based approach to trade equities and derivatives. For long term investing, he prefers ETFs and fixed income.

Besides helping traders find actionable information from data, he is an avid fan of hockey, golf and fishing.