Most traders aren’t fond of a bear market. Sometimes the market dives. Losers outnumber gainers by a large margin. All the major indices are down.

Are there trading opportunities on such days?

The immediate response should be yes. Experienced traders will trade both directions of the market. In a bear market, they will find areas of weakness in the market and execute their shorts.

How we help

Our stock scanner detects these areas of weakness. If you intend to trade on the short side, the bearish targets often look like this:

Our stock scanner help traders discover what is being sold down heavily.

For US stocks, you can go short either by borrowing scrip or buying put options. If you are trading with a non-US domiciled broker, CFDs may be available to you.

Are there opportunities to go long in a bear market?

Not everyone is comfortable with going short, and many traders prefer to be long-biased or long-only.

Although the implied correlation between stocks is high, the market is not a homogenous unified entity. Not all stocks rise and fall in tandem with the broad market.

Finding winners on a down day

There are always supply/demand characteristics that are specific to each stock. There are short-term drivers and trading characteristics that are specific to each stock. We’ve detected many examples of strong gainers on down days.

On the 22nd of March, the Dow dived on the inversion of the yield curve. The market took it as a recession warning.

Yet, there were some notable gainers that day. Several stocks made sizable gains against a falling market.

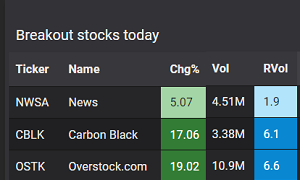

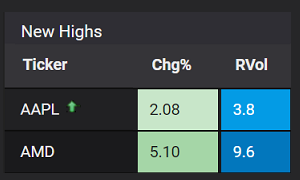

Our scans highlighted several breakout stocks.

We also captured several stocks trending higher despite a sell-off in the broad market.

Summary

1) The indices do not represent the entire market. Not all stocks will move along with the indices or the broad market.

2) There are strong stocks in a bear market.

3) There are weak stocks in a bull market.

4) Market scanners and stock scanners, like the one we have here at Stockbeep, help traders identify strength and weakness across all market conditions.

→ Next: How to find stocks to buy put options on

About the author

David Miller is the Market Data Engineer at Stockbeep. He has spent more than two decades working across dealing rooms, market data vendors and trading ISVs.

For short term trading, David employs a data-based approach to trade equities and derivatives. For long term investing, he prefers ETFs and fixed income.

Besides helping traders find actionable information from data, he is an avid fan of hockey, golf and fishing.