Experienced traders will trade both sides of the market. When the market is bearish, or when specific stocks are weak, traders can profit from the downside with short selling and put options. The short side of the market is in play when:

1) Specific stocks contain fundamental weaknesses.

2) Negative news or events impact specific stocks.

3) The broad market faces geopolitical headwinds.

4) Poor macroeconomic data is released.

5) Governments or central banks shift policies.

6) Corrections and pullbacks can also produce significant shorting opportunities.

The concept of “gravity” used by short sellers

In general, markets drop faster than they rise.

While stocks going up often require high absolute and relative volumes to provide an “uplift”, stocks can fall simply on “gravity”. Trading on the short side is about finding the weakness in the market, taking advantage of the gravity and riding on the free fall.

Most of all, it is finding stocks that do this:

On the 22nd of March, the Dow Jones index nosedived -1.77%. Our stock scanner detected Nike having extreme downward price action.

Put options on Nike that day produced significant gains.

At Stockbeep, our stock scanner covers both gainers and losers, helping traders understand the directional moves in the stock market today.

Opening weakness/gap down

On bearish days the market starts moving down from the opening bell. A weak opening price often translates into a “gap down”.

Our stock scanner has a page dedicated to gap down stocks. This page focuses on stocks which have gapped down and continued to trade lower.

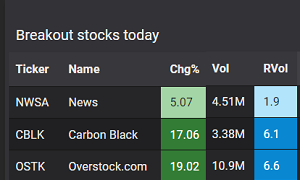

Stocks breaking down today

These are stocks with the most pronounced downward price action. Traders look for losers which are being sold down furiously. Our Breakdown stocks page scans for stocks which have broken below their short-term support levels. We use standard deviation (SD) to measure the magnitude of the price movement.

Stocks going lower on unusually high volume

Our RVol value measures today’s volume flows. This helps traders discover today’s unusual volume losers.

This helps traders identify stocks moving down on unusually high volume for today.

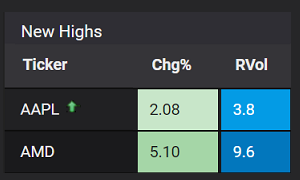

Stocks trending lower

Downtrend stocks are those that are continuing to move lower in a downward price channel. This is often characterized by a series of lower highs and lower lows. Many traders bet on trending stocks, in the anticipation that the trend will continue.

There are several ways of going short:

1) Buy put options.

2) Short selling the stock by borrowing its scrip – check with your brokerage if scrip is available for shorting.

3) CFDs – a type of derivative offered by brokerage houses (take note that this option is not available if you are within the US).

Not all stocks are optionable

Not all stocks have an options market readily available. Among the criteria are share price, number of shares outstanding, average daily volume, and “distribution” (i.e. shares outstanding owned by a minimum number of investors).

At Stockeep, we cover the top 1000 most actively traded stocks across Nasdaq, NYSE and AMEX. Most of these stocks have an average daily volume of at least 1 million shares, and most are optionable.

Summary

1) Experienced traders will attempt to profit from both directions of the market.

2) Trading on the short side is possible by short selling the stock or by buying put options. Put options rise in value when the underlying stock’s price falls.

3) Stockbeep helps traders identify today’s weak stocks that are moving down. We cover the top 1000 active stocks which are mostly optionable stocks.

→ Next: Use stock scanners to improve your trading results

About the author

David Miller is the Market Data Engineer at Stockbeep. He has spent more than two decades working across dealing rooms, market data vendors and trading ISVs.

For short term trading, David employs a data-based approach to trade equities and derivatives. For long term investing, he prefers ETFs and fixed income.

Besides helping traders find actionable information from data, he is an avid fan of hockey, golf and fishing.