Figuring out which stocks to buy is a recurring question for experienced and new investors.

There are, of course, many reasons to buy a stock. Everyone has different investment goals and risk limits. Broadly speaking, there are two reasons to buy a stock – for investment purposes, and for trading purposes.

(Read on, or go straight to our free stock scanner to find what’s moving in the stock market today.)

How investors determine which stocks to buy

If you are a long-term investor, your priorities would be dividend yields, capital protection, price appreciation and inflation hedging. A long-term investor would consider criteria including (but not limited to):

– Dividend payout rates and history

– Credit ratings

– Revenues and cash flow

– Cash balances and liquid assets

– Debts and liabilities

– Earnings growth and history

– Intellectual property

– Economic moats and competitive advantages

– Sector strength and positioning

– Scalability and diversification potential

– Secular trends and business cycles

– Litigation issues and legal disputes

How traders determine which stocks to buy

If you are a trader, your interest would be the price in the short-to-medium term future. Most of our users are traders, therefore in this article, we examine the reasons that will make traders want to buy a stock.

These are the main methods of stock trading:

– Market making

– Arbitrage

– Pair trading

– Directional trading

Most individual-account traders are directional traders. The main aspect of directional trading is to bet on the anticipated future value of the security.

Buying a stock, in anticipation of its higher future value, is also called “taking a long position”.

In directional trading, there are two approaches – “momentum trading” and “reversion to the mean”.

Momentum trading

This entails identifying positive price action, and taking a long position, in the anticipation that the momentum will continue. What momentum traders do, is to “buy high and sell higher”.

In other words, momentum trading is about trend following. For momentum traders and trend followers, their mantra is “The trend is your friend until it ends”.

The pitfall of momentum trading is that the momentum may cease to continue. A trending stock could enter into a ranging mode, or it could reverse downwards.

Another risk factor is that price still oscillates even if the stock is on an uptrend, resulting in retracements. A retracement on an uptrend stock can still take you out on your stop-loss levels, resulting in a losing trade.

That being said, trend following can be a very profitable way to trade. Some trends can go on for a long time, continuing for months and even years.

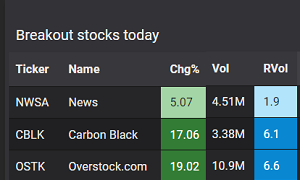

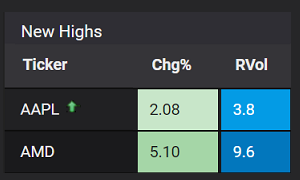

At Stockbeep, our audience utilizes the stock scanner to find meaningful upwards price action. These could be 52 week high stocks, breakout stocks or trending stocks.

Such events typically denote positive price action, which might encourage momentum traders into taking a long position.

Reversion to the mean

Mean reversion posits that a stock price eventually returns to its mean, or “fair value”.

Since we are discussing on which stocks to buy, this means buying stocks whose prices have been depressed too low relative to the “fair value”. In simpler parlance, this would be looking for stocks to “buy low and sell high”. The goal is to buy stocks which are considered “cheap”, with the expectation that price will recover upwards to “fair value”.

The risks are that the anticipated reversion does not occur, or that it may take too long to manifest. Both instances will result in a losing trade.

The notion of “fair value” is an ever-shifting one. There are countless ways to derive “fair value”, and everyone has their own definition. The terms “cheap”, “oversold” and “fair value” are all subjective terms. The market may or may not agree with your assessments.

Furthermore, there is usually a reason why the market dumped the stock. Therefore, when you bet on a reversion to the upside, you are essentially taking a position against the market.

In order to buy stocks “on the cheap”, such traders will look for stocks with recent downward price action. Typically these would be 52 week low stocks, breakdown stocks, or downtrend stocks.

Summary

To determine which stocks to buy, you must first decide:

– How you wish to participate in the market

– How long are your holding timeframes

– What are your investment goals

– How tolerable are your risk limits

If you are a short-to-medium term trader, you are either executing “momentum trading” or “reversion to the mean”.

Momentum trading entails “buying high and selling higher”, which involves identifying positive price action, and anticipating that the price action continues.

“Reversion to the mean” entails “buying low and selling high”, which involves looking for distressed or “cheap” stocks, and anticipating that price will revert to “fair value”. In recent years, this has also become known as “buying the dip”.

Momentum trading is about going along with the market, also known as “following the herd”.

Reversion to the mean is contrarian in essence, and it involves making a judgment call that the stock is “oversold”, combined with the self-belief that you are a better assessor of its “fair value”.

Both approaches have their own risks and rewards. Figuring out your own trading mindset will go a long way in helping you decide which stocks to buy.

→ Next: How active traders find stocks to trade

About the author

David Miller is the Market Data Engineer at Stockbeep. He has spent more than two decades working across dealing rooms, market data vendors and trading ISVs.

For short term trading, David employs a data-based approach to trade equities and derivatives. For long term investing, he prefers ETFs and fixed income.

Besides helping traders find actionable information from data, he is an avid fan of hockey, golf and fishing.