Gaps are an important indication of momentum. Overnight developments often lead to a dislocation of supply and demand during the pre-open phase, leading to “gap up stocks” when the market opens.

(Read on, or go straight to our Gap Up stocks scanner.)

What causes “Gap Up” stocks?

1) Overnight macro events – These could be economic releases from Asia, Europe or domestic figures.

2) Overnight news releases – these are stock specific, which are usually related to earnings and announcements.

There are two kinds of gap up stocks:

1) A partial gap up.

2) A full gap up.

A partial gap occurs when the stock opens higher than yesterday’s close. A full gap occurs when the stock opens higher than yesterday’s high. Full gaps are a stronger indicator of runaway demand than partial gaps.

Most gaps tend to reverse

It is important to note that most gaps tend to get “filled”. Which means price tends to reverse and goes in the opposite direction of the gap, thereby “filling the gap”. This is true for both partial and full gaps.

Which gaps should we look at?

The gaps worth noticing are those that continue to trade in the same direction.

This means stocks that gapped up and went higher, or stocks that gapped down and went lower. Such gaps are also known as breakaway or runaway gaps.

Why gaps are important

A gap that continues to trade in the same direction, signifies the market’s demand to own the stock at higher prices. Traders seek movement and volatility, and such occurrences present meaningful trading opportunities.

How Stockbeep keeps you updated on gaps

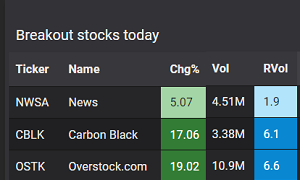

Our stock scanner has a page specifically dedicated to “gap up stocks“. We only qualify stocks that have an opening gap and continued to trade higher beyond the gap.

Selecting the right gaps to trade

1) Identify the presence of any catalysts that could explain the price action. This could be an earnings report, a corporate action or a regulatory development.

2) Determine if the catalyst, price action, absolute and relative volumes justify taking a position.

5) Risk management – a stop at the open, or 1-2 ticks above the open. If price reverts towards the open, the gap is most likely to fill, therefore disqualifying it as a runaway gap.

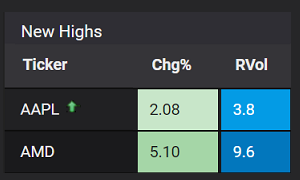

→ Next: The importance of high relative volume (RVol) in stock trading

About the author

David Miller is the Market Data Engineer at Stockbeep. He has spent more than two decades working across dealing rooms, market data vendors and trading ISVs.

For short term trading, David employs a data-based approach to trade equities and derivatives. For long term investing, he prefers ETFs and fixed income.

Besides helping traders find actionable information from data, he is an avid fan of hockey, golf and fishing.